Private Sector Involvement

Private sector involvement in EU plant breeding R&I has grown from 29% in FP7 to 35% in early Horizon Europe. However, private partners in multi-partner projects typically receive half the funding that public sector partners do, while providing in kind contributions. Across Horizon 2020, private sector participants made up 28% overall, yet in plant breeding R&I, they represented only 20%, indicating more potential to enhance private sector participation in EU-level R&I for plant breeding.

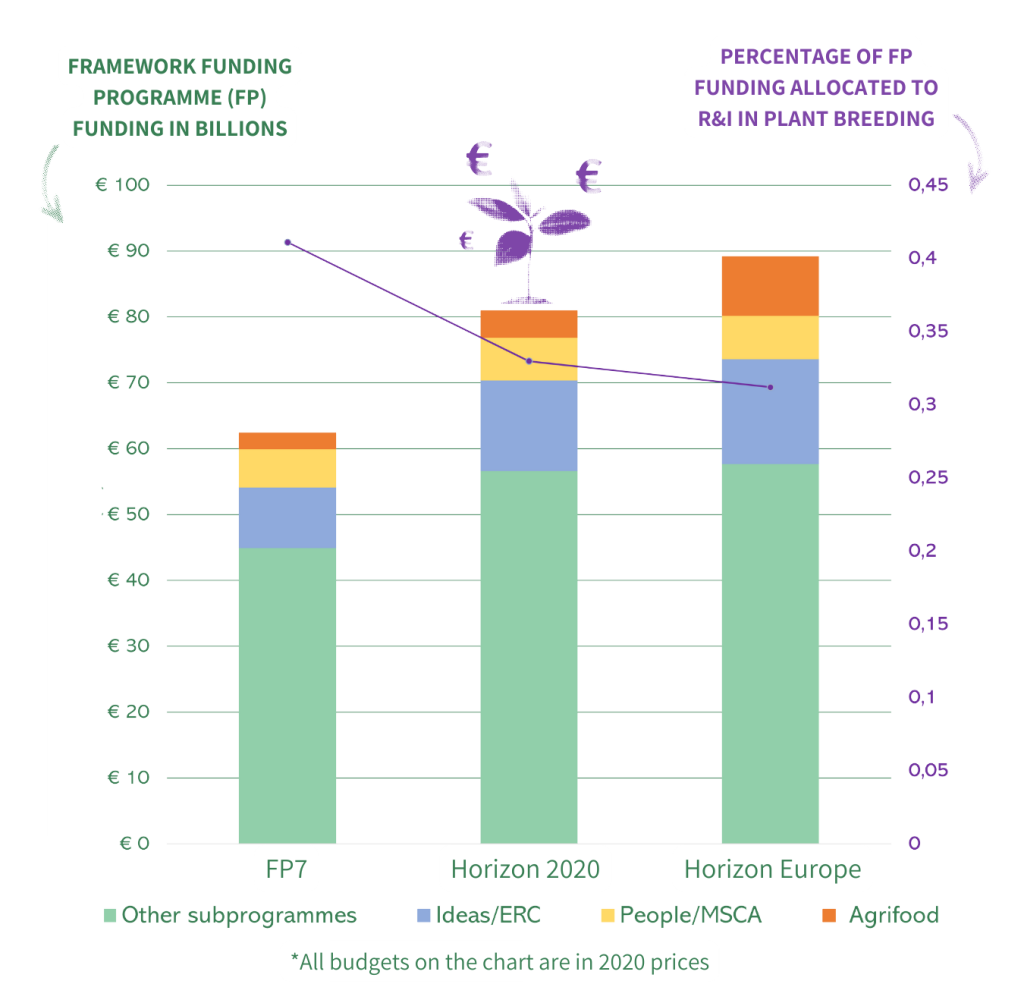

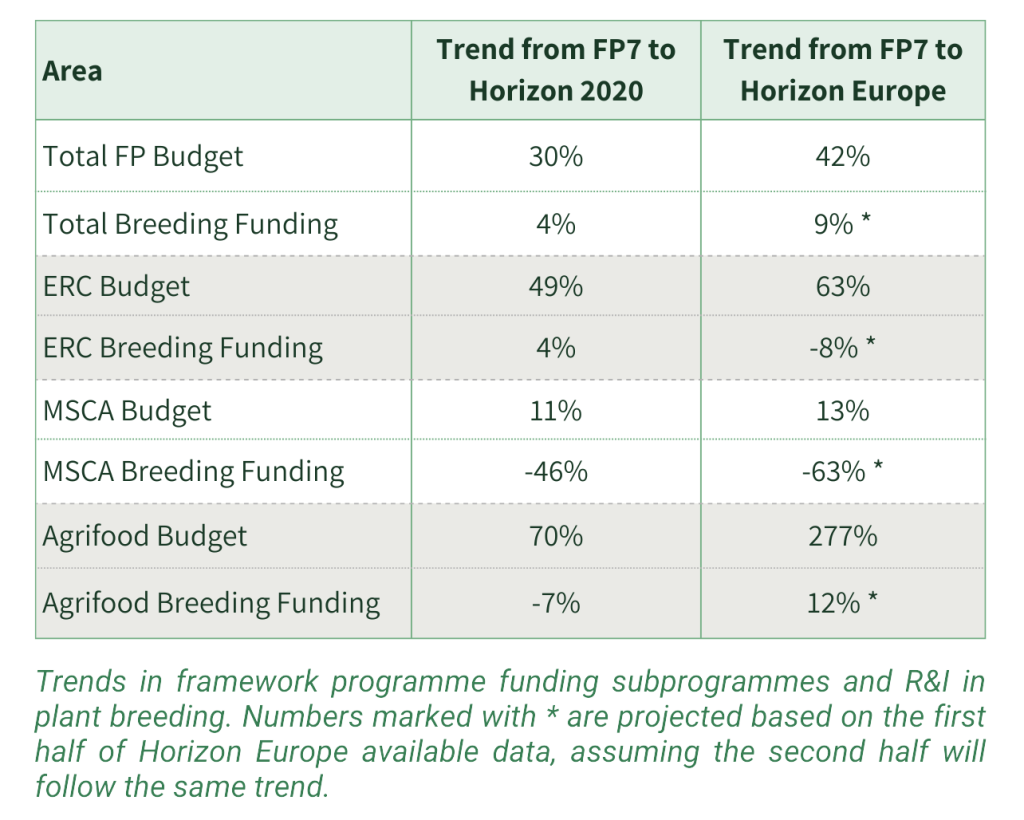

Plant breeding has driven 67% of agricultural productivity gains over the past two decades and holds vast potential to address challenges in both the agrifood value chain and the transition to more sustainable systems. However, maximising its impact requires more strategic investment in R&I across the EU, as well as a coordinated mechanism to support the uptake of research outcomes, such as public-private partnerships.

Recent policy developments, such as the Strategic Plan for Horizon Europe and the Strategic Dialogue on the Future of Agriculture, have highlighted the importance of plant breeding innovation. Similarly, the report on European competitiveness emphasises bridging the innovation gap by leveraging more public-private partnerships, and investing strategically in R&I.

As a result of our report’s findings, and to fully harness the potential of plant breeding in achieving the EU Green Deal goals for more resilient, competitive and sustainable agrifood systems, we, Plants for the Future, put forward the following recommendations:

- Increase funding allocation for R&I in plant breeding by implementing a dedicated, strategic EU-wide coordinated mechanism to support R&I in plant breeding, ensuring close collaboration between the public and private sectors, for maximum impact.

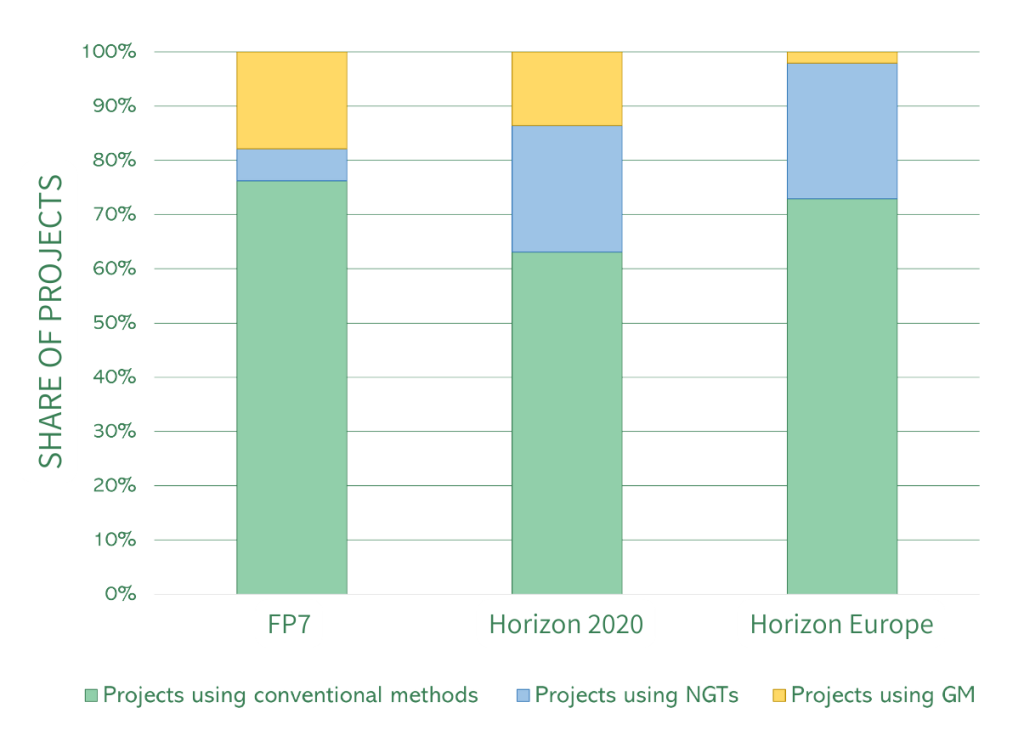

- Promote, or at least do not restrict, the use of plant breeding innovation in plant breeding-relevant calls, so that Europe does not fall behind its global competitors.

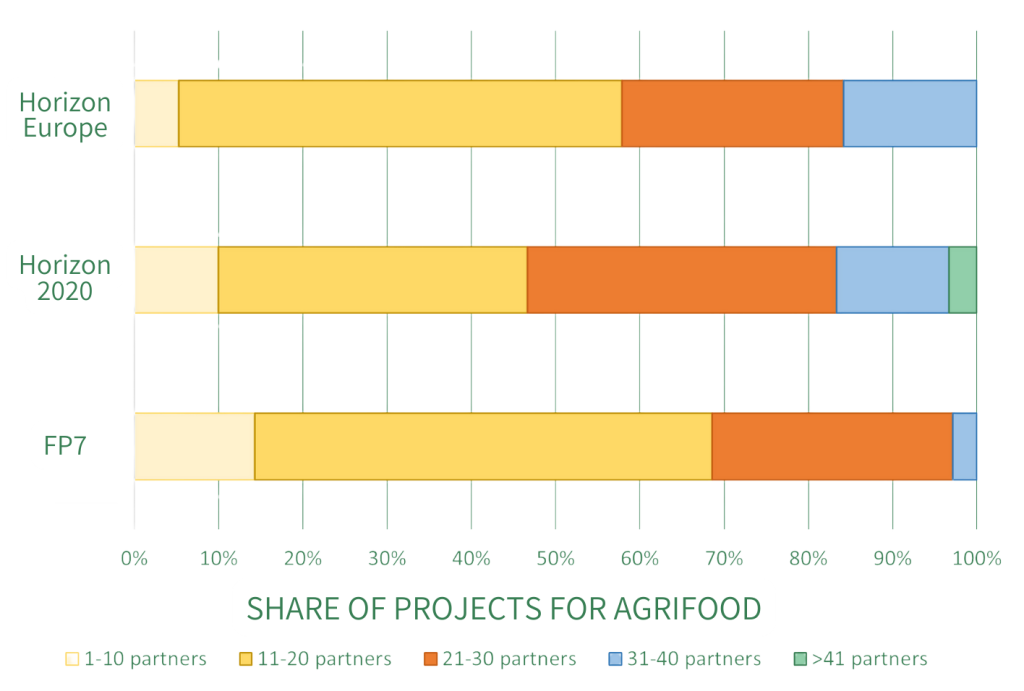

- Provide adequate funding in research calls to enable longer-term plant breeding-related projects, thereby ensuring research outcomes can be fully exploited within the lifetime of the project, or through dedicated research calls aimed at the continuation of successful projects.

- Attract more participation of the private sector in plant breeding-related projects by reducing administrative burden and ensuring sufficient funding.

By addressing these challenges and implementing these recommendations, Europe can unlock the full potential of plant breeding to transiton towards more resilient, competitive and sustainable agrifood systems. Plants for the Future will continue to highlight the important role plant breeding plays in our agrifood systems.

We hope to see the new Commission better leverage plant breeding as a crucial tool to support many of its policy goals, but for that more strategic and collaborative action is needed.

Download the full report here.

Download all figures and tables from the report here.

Find highlight slides of the report here.

Read the press release here.